Corsair Q2 earnings: what a disaster (NASDAQ: CRSR)

Difydave/iStock Unpublished via Getty Images

Investment thesis

corsair (NASDAQ: CRSR) failed to forecast the growth of his business. The company did not meet its results expectations. On the top line, reported earnings slipped from a sharply reduced projection. Management then cut the tips for the top and bottom results of the business.

I think a turnaround is possible. Unfortunately, a high valuation and the risk of dilution make me want to avoid this stock.

Poor results and a heavy guide cut

Corsair’s latest quarterly results have been a disaster. The company reported sales of $294 million, down 40% year-over-year. Adjusted EBITDA was negative and the company lost $0.62 per share in the quarter.

Presentation of Corsair Q2 2022 results

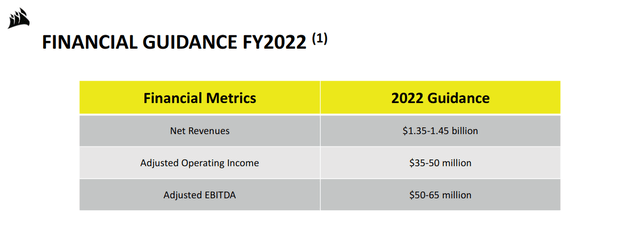

The company cut its revenue forecast to a range of $1.35 billion to $1.45 billion. That’s down 30% from their Q4 2021 guidance. Adjusted EBITDA guidance was cut to a midpoint of $57.5 million, down nearly 75% from to six months ago.

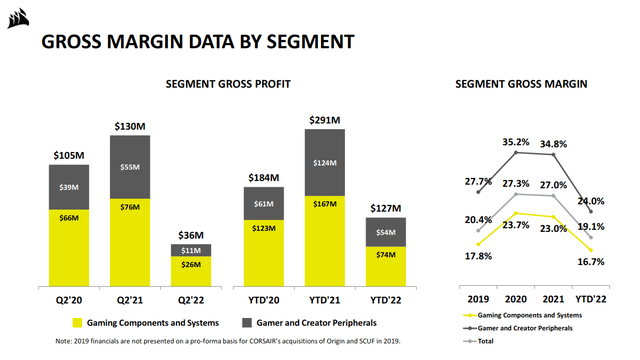

The largest declines were in the company’s peripherals segment. This is Corsair’s most discretionary segment. Sales were down 43% year over year and one-third per quarter. The computer components segment also posted poor results. Revenue fell nearly 40% year over year and 21% sequentially.

Presentation of Corsair Q2 2022 results

Corsair announced a total gross margin of 13% in the last quarter, its worst result ever published. These margins are less than half of what they were in the same quarter last year. In the overall business, the peripherals segment was the hardest hit. This has traditionally been Corsair’s most profitable business. Segment gross margins fell from over 35% to just under 12% year-over-year. This pressure on results caused the company to lay off employees and reduce operating costs.

Corsair’s balance sheet is not good

Corsair has a large inventory surplus on its books. Since their last 10-Q filing, there were 109 days of inventory on their balance sheet. This is the highest number ever recorded. Worse still, supply gluts and demand slowdowns are causing problems across the industry. Management reports that competitors are giving deep discounts on their products. This additional market pressure could further hurt Corsair’s revenue.

The company’s net debt profile is also not excellent. Corsair has $36 million in cash and $240 million in long-term debt. Above all, the interest on this debt is variable. As interest rates continue to climb, the cost of corporate debt will also rise.

It looks like management is laying the groundwork to dilute the company’s stock. The lack of cash on the company’s balance sheet makes it likely that it will raise new capital by issuing shares. The midpoint of management’s forecast implies a 7% increase in shares outstanding by the end of the year.

Stocks are always expensive

Corsair shares are down 70% from their lockdown highs. I still think they are a bit pricey. Even in the last fiscal year, the company had negative free cash flow.

The business trades at a forward EV to Adjusted EBITDA of 26. Forward EV/Sales is just under 1.1 times, which seems high for a business with this gross margin profile . The prospect of double-digit annualized dilution makes this an even riskier game. I think stocks are expensive and prices in a strong long-term comeback.

Is there a light at the end of the tunnel?

Although the short-term outlook is poor, I want to assess Corsair’s long-term outlook.

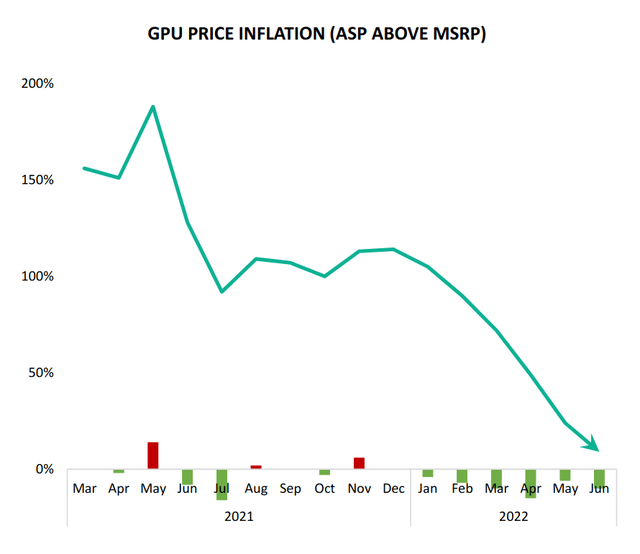

The company pointed to GPU shortages as a key factor holding back demand. GPUs are a key part of high-end PC builds. Management reiterated that it expects this to be a major driver of growth when the shortages end.

Presentation of Corsair Q2 2022 results

GPU prices have now returned to more normal levels. The company discussed the drop during its earnings call.

We expect the second half to show an improvement over the first half, but at lower levels than we expected at the start of the year. In particular, GPU prices have moderated and GPUs are now generally available to our end customers. This, coupled with the exciting product releases expected from us across our product lines, as well as new AMD motherboards and NVIDIA GPUs, should provide a good foundation for improving results in our components business… If the final consumer demand continues to hold, we expect the end of 2022 to provide a good base for 2023.

I think it is possible for Corsair to make a significant comeback. The company generated positive free cash flow last quarter. Management appears to be stabilizing the company’s cash burn rate.

But a turnaround would hinge on an increase in revenue and margins. Management has consistently been mistaken in its outlook. Over the past year, investors have had to deal with repeated and unexpected policy declines.

Take a look at the company’s first quarter earnings call. Management expected the GPU price cuts to create “increased activity in the second half of 2022 and 2023.” It looks like the company is now trying to push back expectations of any inflection points further into the next fiscal year. That worries me. An economic downturn could cause these projections to simply be pushed back.

final verdict

The Corsair district was catastrophic. Margins and forecasts were particularly low. The company keeps repeating an optimistic long-term outlook. It’s possible that it’s a good deep value stock, but I’m not convinced. I think valuation is too expensive for good risk to be rewarded.

I think the directions from management have been vague and inconsistent. I want to see actual results before I consider buying or holding this stock.

Comments are closed.