Record I Bond Rate of 9.62% Expires Soon and Still Not Quick to Buy

I’m reading could be one of the few bright spots in this inflationary economic period. The higher prices gothe more money you get back on your investment in I bonds.

In May, the inflation rate of Series I Savings Bonds hit a record high of 9.62%. This rate lasts for six months after purchase, but it won’t last long. The treasure will fix the new variable rate for I Bonds on November 1, and the last day to buy 9.62% I Bonds will be October 28.

Series I savings bonds have inflation-linked interest rates, which means they pay more when inflation rises. While inflation has slowed in recent months, the projected rate for the next six-month period is around 6%, which is good enough in itself for a risk-free investment.

TreasuryDirect, the site that sells I bonds online, struggled to meet demand for I bonds popularity after the May rate announcement – computer systems crashed and people were waiting for hours.

The site has rebounded since then, with a new redesign and better information resources, but the process for buying and redeeming I Bonds is the same as before.

Read on to learn exactly how to buy Series I Savings Bonds, step by step.

For more useful information on low-risk investments, see our top high yield savings accounts and the best prices on CDs.

How can I buy bonds?

I bonds are sold online at CashDirect. Any U.S. citizen, young or old, can take possession of $10,000 in e-Bonds every year. Additional Paper I Bonds can only be purchased with your tax refund money, up to $5,000 per year (see more below).

To buy Series I Savings Bonds online, you must first create an account with TreasuryDirect. The process is about as bureaucratic as the name of the site might suggest. There are no mobile apps or even a mobile version of the website.

I recommend using a portable Where deskor a device with a keyboard, because there is a lot of information to enter manually, and the virtual keyboard step is next to impossible on a phone screen.

TreasuryDirect has recently been redesigned and looks much cleaner overall. The old landing page was filled with all sorts of links, while the new homepage is now simple and straightforward. Most of the site, research and information sections of TreasuryDirect also sport the new, lighter look and feel.

However, the process for creating an account and purchasing I Bonds is virtually unchanged and remains the same as before the redesign.

PROTIP: Check your bank details. If you make a mistake in your banking information or if you need to change it for any reason, you will have to mail in paper form which is signed in the presence of an “authorized certifying agent”.

- Visit TreasuryDirect.gov and click on the green Opening an account link

- Review the terms and conditions of the site and the information you will need to open an account: social security number; e-mail address; bank account and routing numbers

- Click on the blue Apply now button

- Select the “Individual” radio button and click Submit

- Enter your personal information, including email address, bank account, and routing details, then click Submit

- Verify your information and click Submit

- Select a image and caption (security measure) and Submit

- Choose one the password and answers three security questions (I suggest saving your answers somewhere) and Submit Again

- TreasuryDirect will then email you a account number that is, a letter followed by nine digits. Register your account number.

- Go back to the home page and click on the TreasuryDirect Login Linkthen click on the orange Login button

- Enter the account number that was emailed to you and click Submit

- As this is your first time logging in, TreasuryDirect will send you an email Again with a one-time password — check your emails (and brace yourself!)

- Enter your password and click “Save this computer” to avoid the one-time password on future logins

- Enter your the password. You cannot paste it. You can’t even type it! You must enter it using your mouse and a virtual keyboard (sorry, fellow users of password managers)

- Exhale – you’re in

You need a valid bank account and routing numbers to register for TreasuryDirect.

TrésorDirect/Screenshot by Peter Butler/CNET

When I first purchased I Bonds in August, I experienced more than a few hiccups in the process, including site outages that seemed to be related to high traffic. Based on my last visit to the site, these pains might lessen. On my last trip in and out of TreasuryDirect, BuyDirect and ManageDirect, as well as most of the registration process, the site seems more responsive.

Once you’ve gone through the tricky part of creating a TreasuryDirect account and logging in, buying and cashing in I bonds isn’t too bad:

- After logging in, click BuyDirect at the top of the page

- Below Savings bondsclick the radio button for “Series I” then click Submit

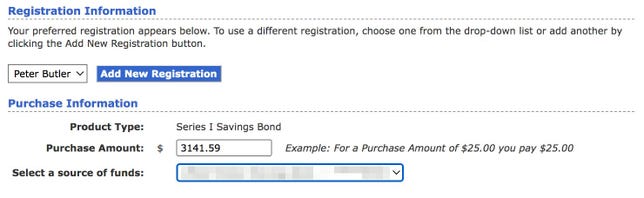

- On the BuyDirect page, enter the amount of the bond you wish to purchase, any exact amount to cents of $25 to $10,000.

- Inasmuch as optional stepyou can set up recurring I Bond purchases at different time intervals, such as a week or a month

- Confirm that your bank account information is correct and click Submit

- Review the terms of your purchase one more time and click Submit for one last time

You can buy I Bonds for any exact amount above $25 and below $10,000.

TrésorDirect/Screenshot by Peter Butler/CNET

You just bought an I Bond!

You will need to wait an additional business day for the deposit to appear in your TreasuryDirect account. But then it’s up to you to keep it or resell it (after one year) whenever you want.

How can I give an I bond to a child or a parent?

If you want to buy I bonds for a child, click on the blue Add a new registration button on the BuyDirect purchase page. Next, create a linked “minor account” before completing your purchase, following the same registration steps above.

Minor accounts are depository accounts that only the primary account holder can access, i.e. the parent or adult who opened the account. You can also use the Add New Record button to buy gift vouchers for anyone with an eligible social security number.

How to buy paper bonds I?

Paper I bonds can only be purchased when you file your tax return each year. To do this, use IRS Form 8888, Rebate Allocationwhich is included in all leader in tax software.

You can designate up to $5,000 a year in total for Paper I Bonds for two beneficiaries – it can be you and your spouse, but it can be two people you love. Your paper bonds will be mailed approximately three weeks after the IRS processes your return.

Paper I bonds feature famous Americans such as Helen Keller and Dr. Martin Luther King Jr.

US Treasury

How do I redeem bonds?

To cash in or redeem your e-Bonds, you will need to log in to TreasuryDirect again. Once you are on your My Account page:

- Click it ManageDirect link at the top of the page

- Select the type of security (savings bonds) you wish to redeem and click on Submit

- Select all of the individual I-Bonds you wish to redeem (up to 50 at a time) and click Submit

- Choose where your money will go on the Redemption Request or Multiple Redemption Request page and click Exam

- Check your information and Submit to complete the takeover

- You’ve paid off your bonds and your money is on its way

You can cash in paper I bonds at most banks with physical branches, although your options exist decreases.

If you don’t have access to in-person banking, you can mail your paper bonds to Treasury Retail Securities Services, PO Box 9150, Minneapolis, MN 55480-9150 in the same way Form FS 1522 of the Tax Service Office.

You will still need to provide account and routing numbers to cash a paper deposit by mail. If you don’t have a bank account, many prepaid debit cards include account and routing numbers that you can use with paper or electronic I bonds.

Don’t forget that you have to wait at least a year to cash in an I Bond. If possible, it’s a good idea to wait five years or more to redeem this investment. If you cash it out before the end of five years, you will miss the last three months of interest earned.

For more low risk investments, see our lists of best high yield savings accounts and best CD prices.

Comments are closed.