Corsair Gaming, Inc.: Still in the game for now (NASDAQ: CRSR)

gleitfrosch/iStock via Getty Images

Investment thesis

Corsair Gaming Inc. (NASDAQ: NASDAQ: CRSR) the recent launch of DDR5 does not appear to be a game-changer for the company’s competitive advantage. The product is top of the line in terms of hardware specifications, but this technology is is not owned by the company, which means that the barrier to entry is very low for other competitors.

CRSR is a market leader in the niche but growing market of “mechanical keyboard” products. The latest limited edition release of these products seems to be helpful in boosting the company’s brand recognition in this area.

Scuf Gaming, which was acquired by CRSR in 2019, is currently a key player in the gaming controller market. Scuf’s latest controller for the PlayStation 5 platform appears to further cement the market leadership position.

Financially, CRSR does not appear to have a clear advantage when key financial ratios are compared to those of its peers. Based on the current intrinsic value of the company, the stock price appears to be fair valued.

Despite a few new products with long-term market-leading potential, financiers currently show no clear advantage over their competitors. Even if fairly valued, long-term investors should consider whether the company is able to produce a clear competitive advantage over its long-term competitors.

Company presentation

CRSR is on a mission to provide high-performance gear to gamers and content creators. Based on the 2021 annual report, the products are grouped into 2 main categories:

- Gamer and Creator Peripherals: “Includes high-performance keyboards, mice, headsets and game controllers. Streaming equipment includes capture cards, Stream Decks, USB microphones, our “Facecam” streaming webcam, studio accessories and the “EpocCam” webcam app, as well as coaching and training services and content design services, among others.”

- Game components and systems: “Includes high-performance power supplies or power supplies, cooling solutions, computer cases, DRAM modules, as well as high-end pre-built and custom gaming PCs, among others.”

The company recently launched a few new products which we will explore in detail whether they have long-term prospects to become market-leading products.

The launch of Corsair DDR5

CRSR recently announced the launch of DDR5, which is actually an incremental upgrade from DDR4. This launch targets the gaming community who want the best hardware for their gaming experience. Online reviewers like “Tom’s Hardware” and “TechRadar” have given very favorable reviews for CRSR’s DDR RAM products, which is a good sign. . Management also mentions in the latest earnings call that new DDR5 products sold out after the initial launch.

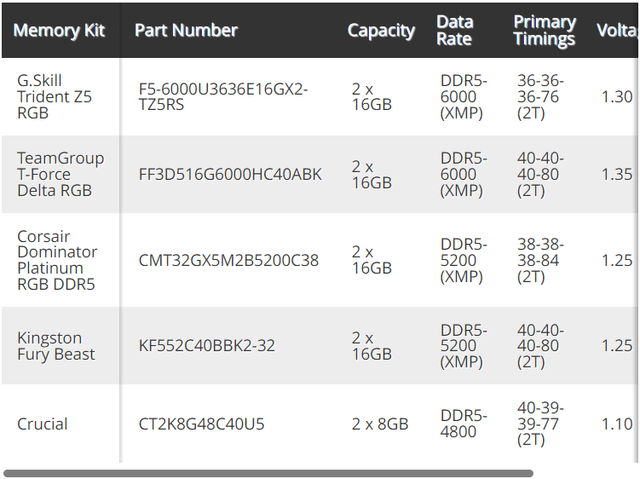

While initial customer reception seems positive, I want to know if there is a clear and visible competitive advantage that the new DDR5 RAM product can offer customers. Based on this hardware comparison list, CRSR’s DDR5 product doesn’t seem much different in terms of hardware specs. Hardware components like RAM become obsolete very often. In the long run, it appears that the switching costs associated with using other competing products are minimal.

Tom’s gear

Indeed in the last 2021 annual report, competitors like G.Skill and Kingston are cited as worthy competitors of CRSR:

Annual report 2021

Even with the initial success of the new DDR5 RAM, it remains to be seen if this product’s popularity is sustainable in the long term.

CORSAIR launches a range of limited-edition keyboards

CRSR launches a new line of “CORSAIR K65 RGB MINI 60% Mechanical Gaming Keyboards”. Here are the main features of the products:

- It is a “mechanical” keyboard as opposed to the more common “membrane” keyboards. As this article explains, mechanical keyboards appeal to gamers because pressing each key produces a more definitive click than a normal membrane keyboard.

- The form factor is a “60%” type, which means that the number of keys it contains is pretty much reduced to just 60% of its full range of 104 keys. As explained in this article, this form factor is aimed at a niche audience of keyboard enthusiasts looking for a more minimalist and compact design that does away with less-used keys like numeric keypads.

- It displays an RGB lighting spectrum. As this article explains, RGB simply refers to the primary color of red, green, and blue. By mixing different intensities of each of these primary colors, you are able to achieve any visible color lighting required. In short, it’s just a fancy way to describe the keyboard as having the ability to be lit with any color. This appeals to customers who are more aesthetically inclined, and it’s not a core function of a keyboard.

Generally, mechanical keyboards mainly cater to a niche group of enthusiasts. However, as this article suggests, this market is “niche, but growing”. A study by Market Research Future has also predicted that this niche market has the potential to grow with a CAGR of 12.7% from 2020 to 2030. In the same report, CRSR is also one of the key players in this market in full growth. Therefore, the latest limited edition release of these products seems to be helpful in boosting the company’s brand recognition in this area.

Surf Game Controller Market Leader Status

CRSR has released a new SCUF controller designed for PlayStation 5. In this section, we explore the long-term prospects of this new product in the game controller market.

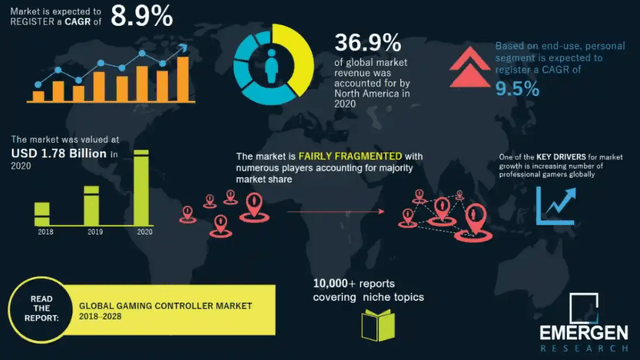

Overall, the game controller market is expected to grow at a CAGR of 8.9%, according to this report from Emergen Research. In the same report, it is also mentioned that this market is quite fragmented.

Emerging research

Even in this fragmented market, we noted that “Scuf Gaming” is currently one of the key players in the gaming controller market, along with a few other competitors mentioned in this report.

Scuf Gaming was acquired by CRSR in 2019 to include high-end gaming controllers in its product portfolio. Therefore, we noted that since its acquisition 3 years ago, Scuf Gaming has helped CRSR achieve leadership status in this fragmented gaming controller market.

On the latest earnings call, management also mentioned that “customer demand was just incredible and we saw our initial launch stocks sell out within minutes.” This is another attestation of CRSR’s Scuf controller market-leading status.

Financial discussion

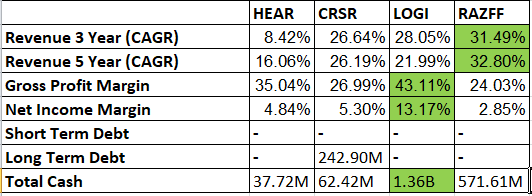

CRSR competes with other gaming-related companies in the computer hardware and peripherals segment. We will compare CRSR’s financial statements with some of these publicly traded companies. The green highlight represents the best performing value in the comparison list.

Author tab

Here is the information we may collect:

- Razor has seen the strongest revenue growth over the past 3 and 5 years. CRSR and LOGI come in 2n/a place with a respectable twenty in percentage of growth.

- Regarding gross margins, the products and services of LOGI and HEAR seem to be better received in the market, since they have the highest gross margins at nearly 40%.

- In terms of net income, LOGI is clearly the most profitable with a net income above 10%. The other peers in the comparison list are in the single digit range.

- Not only is LOGI the most profitable, but it is also much more cash-rich than the others in the comparison list.

Overall, in terms of key financial ratios, CRSR seems to fare only slightly better than HEAR in the comparison list. In my opinion, CRSR’s financial profile seems “modest” at best. There is no visible competitive advantage over other peers in the market.

Evaluation

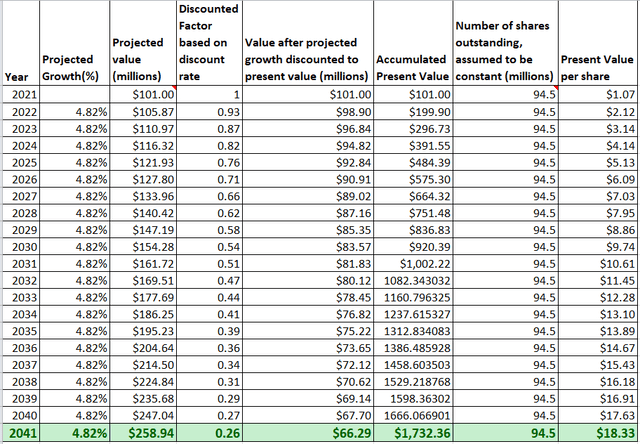

We will make the following assumptions in our valuation of the company using the 20-year discounted net income model:

- According to Finviz analysts, the CRSR is only expected to grow by 4.82% over the next 5 years. For our 20-year discounted net income valuation model, we will assume that the business will grow at the same rate of 4.82%.

- The discount rate is estimated at 7.05% referenced by Alpha Spread.

Based on the above data, the present value (PV) of projected net earnings per share for CRSR is $18.33.

Author’s calculation

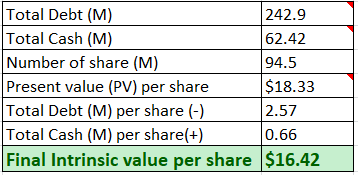

Taking into account the total debt and cash held by the company, the final intrinsic value is $16.42

Author’s calculation

The current price of around $15 implies that the stock is roughly at fair value.

Investment risks

CRSR’s financial profile appears modest compared to its competitors. Not all recently launched products have a strong chance of dominating the market in the long term. Investors who intend to hold these shares as a long-term investment should be aware of the questionable long-term performance of its products and services.

Conclusions and key points for investors

Generally, the gaming equipment market is quite fragmented and there is no player with a clear competitive advantage to establish a wide economic moat to protect against other competitors.

CRSR offers a wide range of products and services for the gaming community and only some of its recent products appear to have market-leading potential, as discussed in previous sections. Its financial profile does not clearly indicate that it is ahead of its competitors.

The stock is currently at fair value. Investors should hold and wait until the stock price becomes significantly undervalued to enter a position, to ensure a higher margin of safety.

Comments are closed.