Consumption inequalities in the digital age

Is digitization making the world more unequal? Economic research so far seems to suggest yes. There is substantial evidence that digitalization is leading to increased income inequality in the Western world (Akerman et al. 2015, Gaggl and Wright 2017, Burstein et al. 2019).1 As the literature shows, information and communication technologies (ICT) tend to make highly skilled workers more productive, while low-skilled workers are often laid off. As a result, the skill bonus increases.

So we know a lot about digitization and revenue so far. From a welfare perspective, however, we care more about consumption. Digitization affects consumption inequalities not only through changes in income, but also through changes in consumer prices. A priori, it is not clear whether this price effect acts in the same direction or in the opposite direction to that of the income effect. If the increased use of digital technology makes some consumer goods cheaper than others, it will benefit income groups that consume relatively more of those goods. Depending on the nature of these goods, rich or poor households could be the beneficiaries.

In a new article (Arvai and Mann 2021), we study the effect of digitalization on consumption inequalities, quantifying both the income effect and the price effect. We use US household data to show that the price effect works in the same direction as the income effect, favoring high-income households. In a two-sector growth model, we show that the price channel accounts for 22.5% of the increase in consumption inequality between 1960 and 2017. This implies that digitalization has more unequal effects than suggested by the increase in income inequality.

Digitization and consumption inequality in data

To study how households differ in their consumption of digital products, we develop a new measure of the share of ICT in consumer goods. Our approach focuses on the stock of capital used in production and we study the extent to which an industry uses digital assets, such as computer software and hardware or intellectual property products, rather than non-digital equipment and structures such as production plants.

Collating data on 61 industries between 1960 and 2017, we find that the average share of ICT capital in the overall capital stock increased from virtually 0% in 1960 to 16% in 2017, with large variations across industries. We take into account the digitization content of intermediate products based on the input-output structure of the production network and derive a measure of digitization of final products.

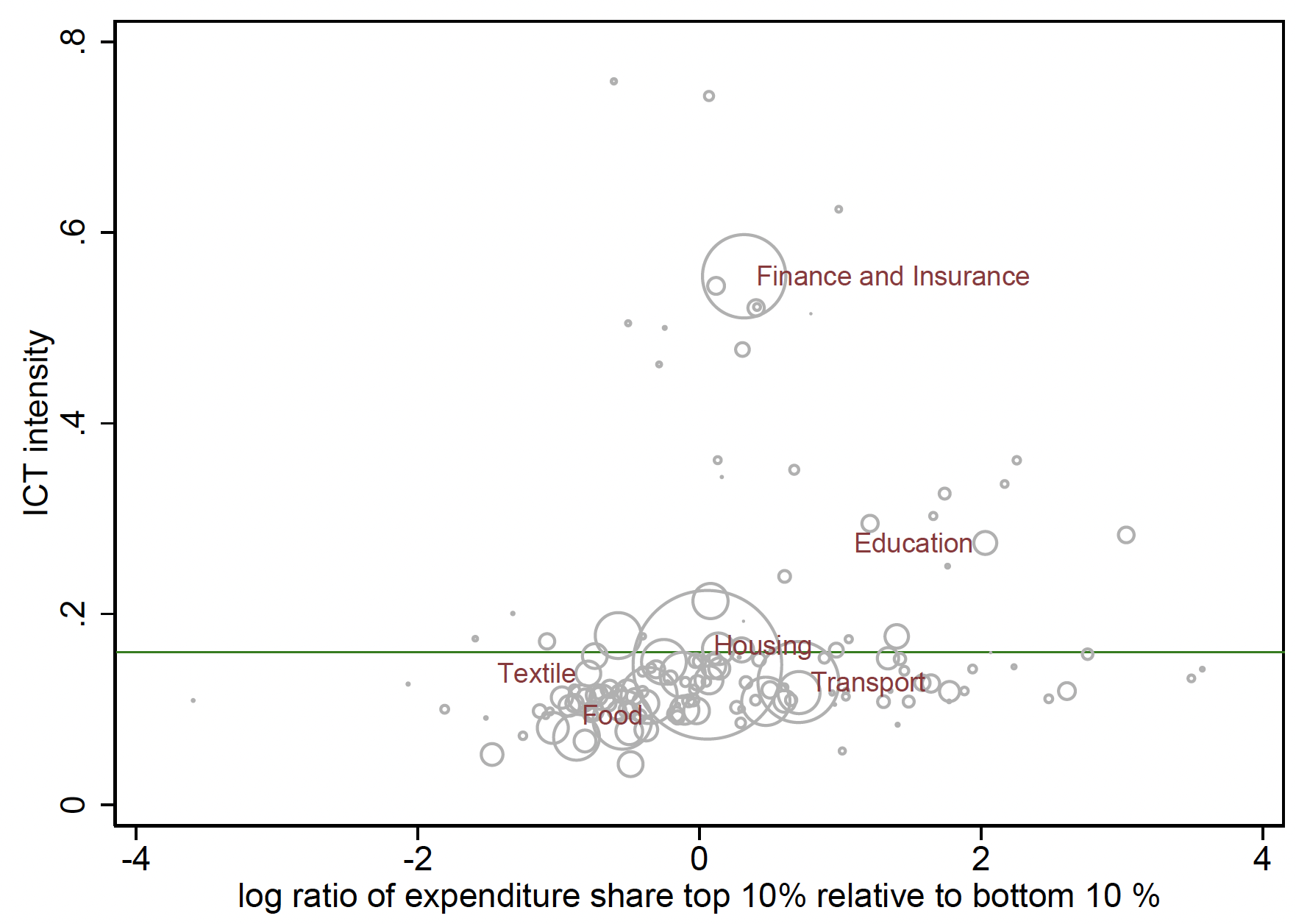

We link this measure to the US Consumer Expenditure Survey, an annual survey of US household spending habits, and thus calculate the overall share of ICT in individual household consumption. Figure 1 shows which categories are important for high and low income households and how they differ in their ICT intensity. Low-income households disproportionately consume food and textiles, which are produced using a small share of ICT. In contrast, categories that tend to be more important to rich households, such as finance and insurance or education, have higher ICT shares. We also find that consumer price inflation has been lower for ICT-intensive commodities, implying that digitalization benefits consumers of ICT-intensive goods.

Figure 1 ICT intensity and relative expenditure shares by product in 2017

Remarks: Each circle corresponds to a commodity. The size of the circle reflects the share of expenditure for this category of the median household. The x-axis shows the logarithmic ratio of the share of spending of the top 10% to the bottom 10%. The further to the right, the more important a category is for the wealthy. Values around zero indicate that a category is equally important to rich and poor. The y-axis shows the TIC intensity of the product, the horizontal green line indicates the average TIC intensity. Data is for 2017.

Source: BEA, CEX and own calculations.

Figure 2 shows our aggregate measure of ICT consumption intensity for households at different percentiles of the income distribution. Households in the tenth percentile have a 13% higher share of digital in their consumption basket than households in the first percentile, and the difference has widened over time.

Figure 2 ICT intensity along the income distribution

Remarks: The graph shows the share of ICT in the consumption basket by percentile for different sub-periods.

Source: BEA, CEX and own calculations.

A simple model to quantify the revenue and price channel

To determine the importance of price changes and income changes for consumption inequality, we construct a two-sector growth model. The output of both sectors is produced using two types of capital, ICT capital and non-ICT capital. Sector 2 uses ICT capital more intensely than sector 1. The economy is populated by two types of agents who differ in their endowment of skills. Highly skilled labor is complementary to ICT capital, while a composite good constructed from these two inputs is substitutable for low-skilled labor. Digitization is modeled as an increase in the rate of transformation of production into ICT capital (Karabarbounis and Neiman 2014). ICT-intensive sector 2 benefits relatively more from this technological trend, which means that the relative price of sector 1 increases. At the same time, the skill bonus increases. In a context of non-homothetic preferences, the effect of the modification of relative prices depends on the position of the agent in the income distribution. Consistent with our empirical results, we assume that the ICT-intensive good is the luxury good, which is consumed more intensely by high-skilled and high-income households.

We calibrate the model on the US economy between 1960 and 2017 to match both the increase in the skill premium and the increase in the relative price of non-ICT goods. Consumption inequalities increased by 18.1%. To express this number in monetary units, we make a compensating variation, asking ourselves how much additional income we must give to households in 2017 to compensate them for the relative price variation. Then we compare that number to the actual increase in revenue. The left panel of Figure 3 shows that higher income households benefit both by demanding a lower level of compensatory income and by receiving a larger increase in their real income. They experience an increase in well-being that is equivalent to 22.3% of their initial income, while low-skilled households only experience an increase of 5.3%.

To assess the relevance of the revenue and price channel, we perform a counterfactual exercise. We quantify the extent to which the price channel contributes to consumption inequality by comparing consumption in the reference model to a version with fixed relative prices. The right panel of Figure 3 shows that without the change in relative prices, consumption inequality would have increased by 22.5% less. It is therefore important to take into account the price channel. By providing a first estimate of the size of this channel, our article offers a starting point for further follow-up research on the effect of digitalization on well-being and inequality.

picture 3 Breakdown of well-being

Remarks: Left panel shows household income with offsetting variation (blue) and real household income in 2017 (red) relative to initial 1960 income. Right panel shows relative consumption in the reference model ( solid red line) and in a counterfactual exercise where prices remain constant (dashed blue line).

The references

Acemoglu, D and D Autor (2011), “Skills, tasks and technologies: implications for employment and earnings”, in Labor economics textbook 4: 1043–1171. Elsevier.

Akerman, A, I Gaarder and M Mogstad (2015), “The Complementarity of Broadband Internet Skills”, The Quarterly Journal of Economics 130(4): 1781-1824.

Arvai, K and K Mann (2021), “Consumption inequalities in the digital ageSSRN Working Paper.

Author, DH, LF Katz and MS Kearney (2008), “Trends in Wage Inequality in the United States: Revising the Revisionists”, Review of Economics and Statistics 90(2): 300–323.

Burstein, A, E Morales and J Vogel (2019), “Changes in Inequality Between Groups: Computers, Professions and International Trade”, American Economic Journal: Macroeconomics 11(2): 348-400.

Gaggl, P and GC Wright (2015), ‘A Short-Term View of What Computers Do: Evidence of a UK Tax Incentive’, VoxEU.org, 20 August 2015.

Hemous, D and M Olsen. (2020), “The Rise of Machines: Automation, Horizontal Innovation and Income Inequality”, American Economic Journal: Macroeconomics (future).

Karabarbounis, L and B Neiman (2014), “Labour share, inequality and the relative price of capital”, VoxEU.org, 15 Nov.

Endnotes

1 When considering automation more broadly, the evidence is even stronger (eg, Autor et al. 2008, Acemoglu and Autor 2011, Hemous and Olsen 2020).

Comments are closed.